Describe What a Tariff Is and Its Economic Effects

It adds to the cost borne by consumers of imported goods and is one of several trade policies that a. Describe what a tariff is and its economic effects.

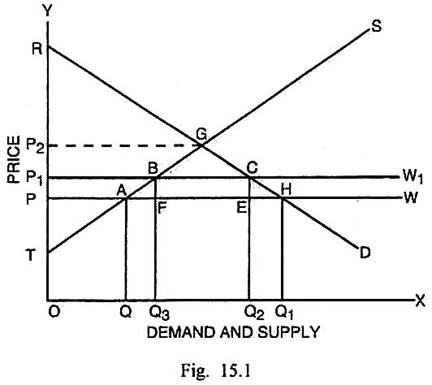

Effects Of Tariffs Under Partial Equilibrium International Economics

Economic Effects of Tariffs A tariff is a tax imposed by a state on goods and services imported or exported to or from a given country.

:max_bytes(150000):strip_icc()/TariffsAffectPrices2_2-f9bc0f6dc8f248eb8c6e22ad499b66c0.png)

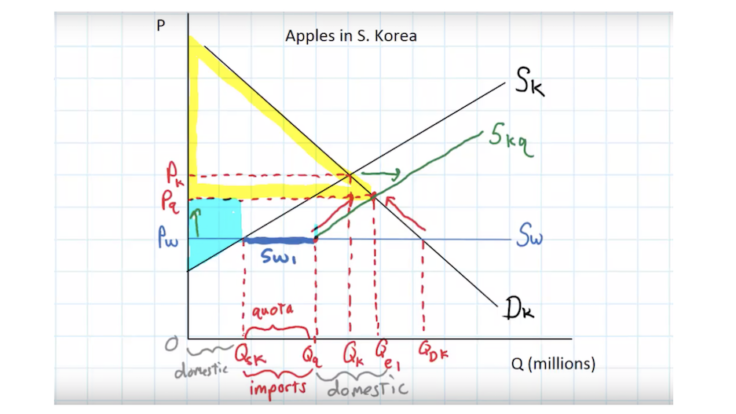

. A tariff is a tax imposed on the import or export of goodsIn general parlance. Describe the larger economic effects of the policies in the previous question. Firstly there is an improvement in the terms of trade of the tariff- imposing country.

Describe what a tariff is and its economic effects. These effects of tariff can be shown through Fig. Solution for Describe what a tariff is and its economic effects.

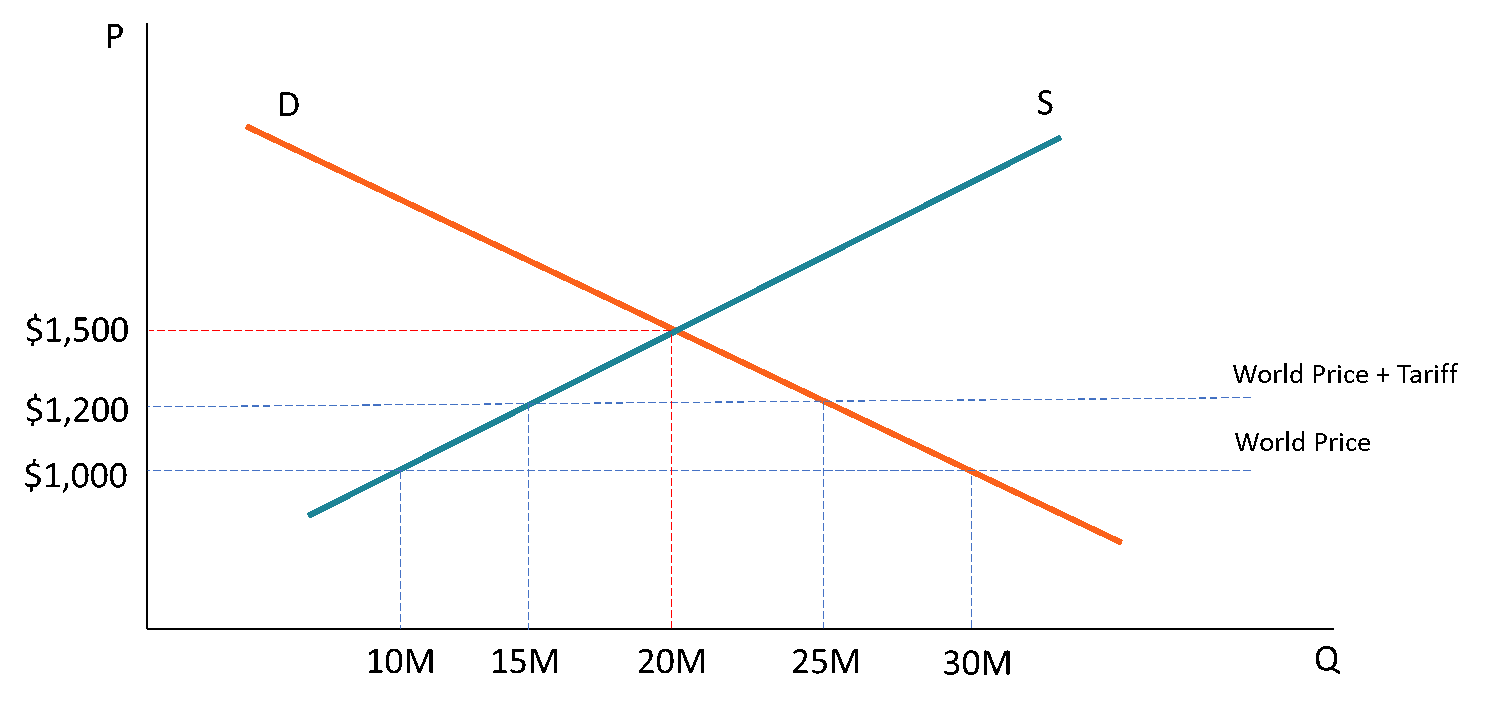

Define a tariff and describe its economic effects. Price effect of an import tariff is the change in the domestic price of G which has been subjected to an import duty. The tariff is essential only if the country is an importer.

Looking for the textbook. Describe what a tariff is and its economic effects. Principles of Microeconomics 7th Edition Edit edition.

In our illustration this price effect is an increase in the price of G equal to the rate of tariff T. First week only 499. A tax on imports-moves a market closer to the equilibrium that would exist without trade and therefore reduces the gains from trade.

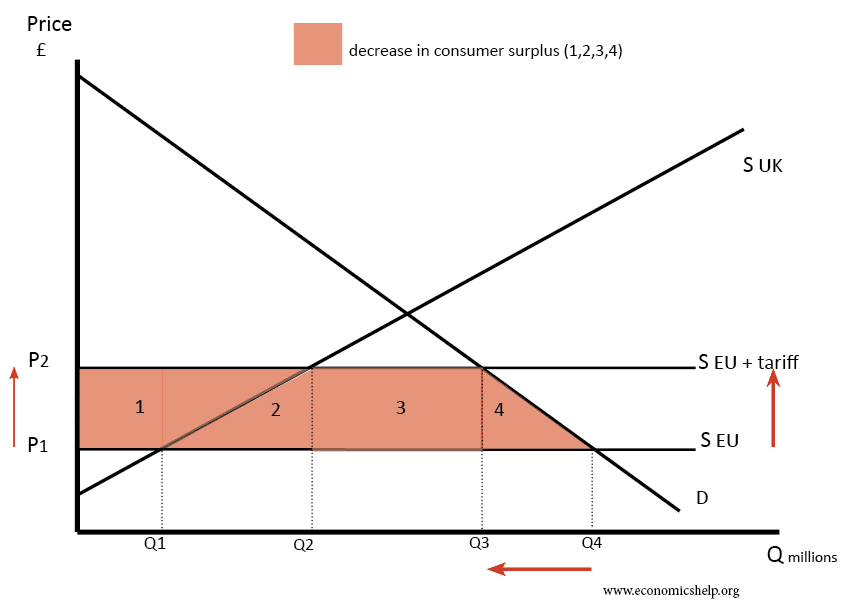

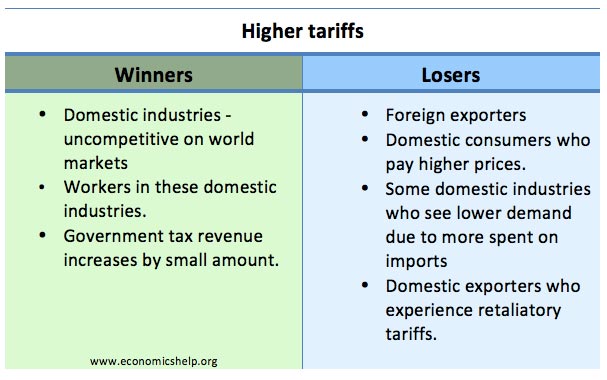

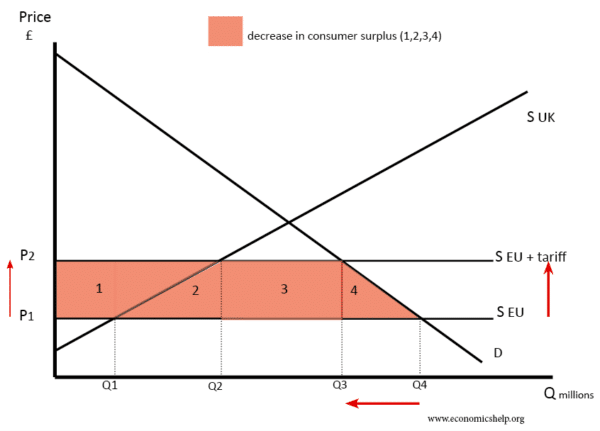

In simplest terms a tariff is a tax. If a country resorts to the imposition of tariff while the foreign country does not retaliate two types of effects can follow. Importing Country Consumers - Consumers of the product in the importing country suffer a reduction in well-being as a result of the tariff.

As a tariff raises the price of a product it reduces the domestic quantity demanded and raises the domestic quantity supplied. Taxes have been a. This simple description enables us to identify the partial equilibrium effects of a tariff as follows.

Get solutions Get solutions done loading. Solutions for Chapter 9 Problem 4QR. Describe the larger economic effects of the policies in the previous question.

If a country is exporting this good the tariff has no effect on them. Solutions for problems in chapter 9 1CQ. Principles of Macroeconomics 5th Edition Edit edition Solutions for Chapter 9 Problem 4QR.

9780324600902 9780324824490 9780324824599 9780324824636 9780324824704 9781111115968 9781111806989. This problem has been solved. That is what would be the effects on income consumption employment interest rates and real exchange rates of policies designed to reduce or eliminate the current account deficit.

Describe what a tariff is and its economic effects. Trade barriers such as tariffs have been demonstrated to cause more economic harm than benefit. Indeed one of the purposes of the WTO is to enable Member countries to negotiate mutual tariff reductions.

A tariff increases the internal. Describe what a tariff is and its economic effects. A tariff is a monetary restriction imposed on the export and import of goods and services.

Taxation refers to the imposition of levies or financial obligations by an authority on a countrys citizens. A tariff is a tax that is imposed on imported commodities. A tariff is a tax imposed on imported goods and services.

Principles of Macroeconomics 9th Edition Edit edition Solutions for Chapter 9 Problem 4QR. Want this question answered. Describe what a tariff is and its economic effects.

Note that the price rise equals the tariff rate because H is a small. Principles of Macroeconomics 8th Edition Edit edition Solutions for Chapter 9 Problem 4QR. See full answer below.

A tariff is a tax on imported goods. Although domestic producers are better off and the government raises revenue the losses to consumers exceed these gains. Answer Tariffs are the most common kind of barrier to trade.

The increase in the domestic price of both imported goods and the domestic substitutes reduces the amount of. View the full answer. Describe what a tariff is and its economic effects.

They raise prices and reduce availability of goods and services thus resulting on net in lower income reduced employment and lower economic output. Secondly the tariffs result in the contraction in the volume of trade. A tariff is a compulsory charge that should be given by the.

A tariff raises the price of imported goods above the world price by the amount of the tariff and brings it closer to the price that would prevail without trade by reducing quantity of. Gregory Mankiw Rent Buy. This moves the domestic market closer to its equilibrium without trade.

Start your trial now. Describe what a tariff is and its economic effectsA tariff is a tax on good produced abroad and sold domestically. Describe what a tariff is and its economic effects.

/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

The Basics Of Tariffs And Trade Barriers

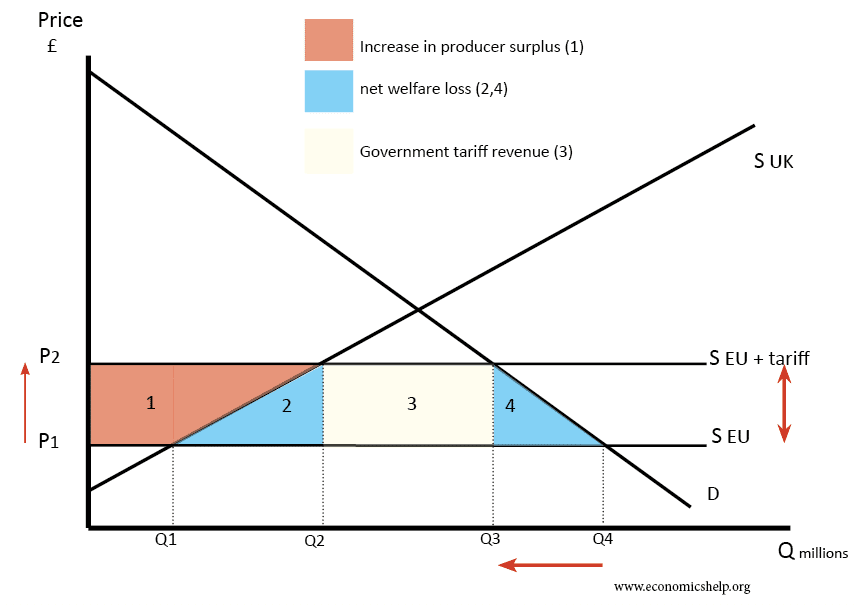

Benefits And Costs Of Tariffs Economics Help

Quotas Versus Tariffs Hinrich Foundation

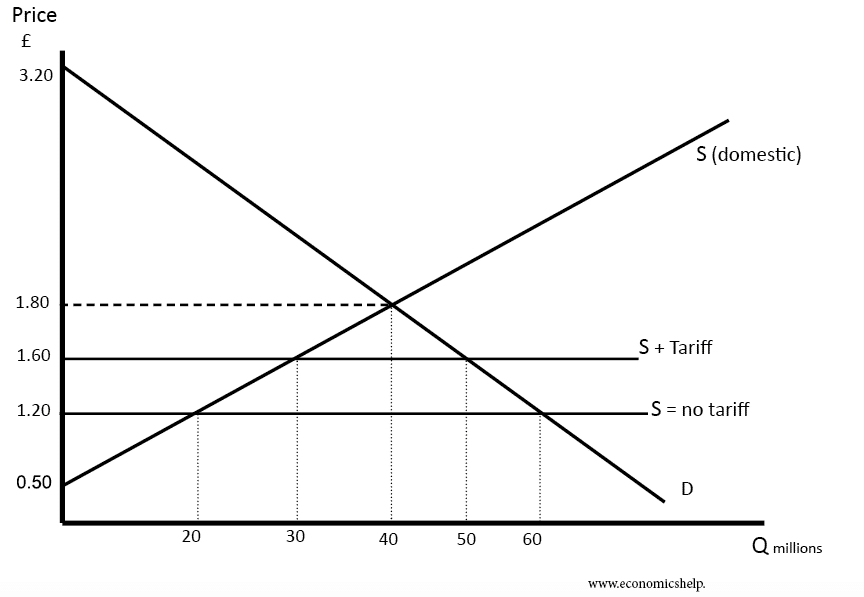

Effect Of Tariffs Economics Help

Effect Of Tariffs Economics Help

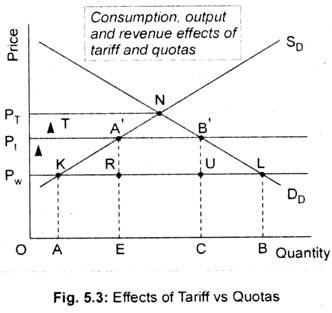

Difference Between Tariff And Quotas With Diagram

It S Time We Had A Talk About Tariffs Cato Institute

4 9 Tariffs Principles Of Microeconomics

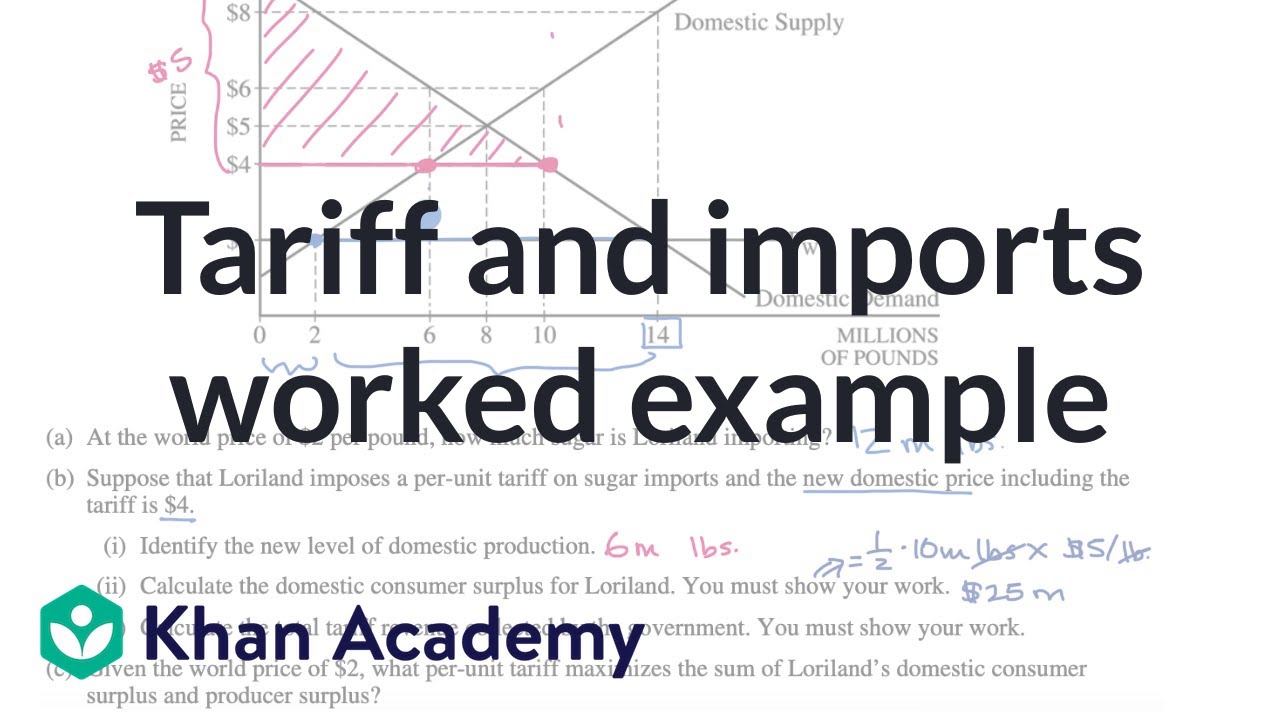

Sample Free Response Question Frq On Tariffs And Trade Video Khan Academy

Effect Of Tariffs Economics Help

4 9 Tariffs Principles Of Microeconomics

Tariff Definition Different Forms And How It Works

4 9 Tariffs Principles Of Microeconomics

:max_bytes(150000):strip_icc()/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

The Basics Of Tariffs And Trade Barriers

Comments

Post a Comment